2021 ev charger tax credit

The Build Back Better bill would give EV buyers a 7500 tax credit through 2026 to charge up sales. Purchasing an EV Charging Station in 2021.

How Much Do Ev Charging Stations Cost Expect 6 000 On Average

A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent.

. Grab IRS form 8911 or use our handy guide to get your credit. This incentive covers 30 of the cost with a maximum credit of up to 1000. Heres how to claim your credit for 30 of the cost of your home charger and installation up to 1000.

For residential installations the IRS caps the tax credit at 1000. Fueling equipment for natural gas propane liquefied hydrogen electricity E85 or diesel fuel blends containing a minimum of 20 biodiesel installed through December 31 2021 is eligible for a tax credit of 30 of the cost not to exceed 30000. By Andrew Smith February 11 2022.

Get Up to 30000 Back for EV Charging at Your Business Purchase and install your EV Charging station by December 31 2021 and your business may be able to receive a 30 tax credit up to 30000. Would qualify for the credit. Federal Tax Credit Up To 7500.

The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit. JonB65 C Cjacktesmy Member. The federal tax credit was extended through December 31 2021.

How to Claim Your Federal Tax Credit for Home Charging You might have heard that the federal tax credit for EV charging stations was reintroduced recently. The tax credit is retroactive and you can apply for installations made from as far back as 2017. Just buy and install by December 31 2021 then claim the credit on your federal tax return.

First decide on the car you want and find out if the automaker has EV tax credits available for buyers. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Claiming your EV federal tax credit is a fairly straightforward process.

Officials view tax incentives of up to 12500 per vehicle in the new bill as a much needed second step to spur the adoption of electric vehicles. More Information Plug-In Electric Drive Vehicle Credit IRC 30D Related Forms The 30D a credit is claimed on Form 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit Including Qualified Two- or Three-Wheeled Plug-in Electric Vehicles PDF. And the base credit rises by 4500 if the vehicle is made at a US.

The cost of the installation is 23000. Up to 1000 Back for Home Charging. Residential installation can receive a credit of up to 1000.

I have a client who wants to know if he installs a Tesla battery in his house in case of a power outage if he can claim a tax credit. Use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year. To qualify for the credit the property needs to be operational in the tax year and used predominately inside the United States.

Must be purchased and installed by December 31 2021 and claim the credit on your federal tax return. Plant that runs under a union-negotiated collective bargaining agreement. The credit is 10 of the purchase price of the vehicle with a maximum credit of 2500.

SUBJECT Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40 percent credit for costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle. Up to 7500 federal income tax credit for purchase of new electric vehicle Not available for GM or Tesla Up to 30 federal tax credit to install charging equipment Install by 123121 Up to 1000 for home installations Up to 30000 for businesses Electric. The tax credit now expires on December 31 2021.

Since installation costs are significant for EV chargers this rule allows you to get the most tax credit for your. The credit is the smaller of 30 or 1000. Similar tax breaks have expired and been extended in recent years and in its current form it applies to property placed.

As noted above after the automaker has sold 200000 vehicles the credit is reduced to 50 percent of the original amount. Can however build distributed microgrids that accelerate the energy transition through market. Co-authored by Stan Rose.

Purchase and install your ChargePoint EV Charging station by using December 31 2021 and your commercial enterprise can be able to obtain a 30 tax credit up to 30000. Mar 12 2021 767 700 Atlanta GA May 17 2021 6 The US Federal Tax Credit gives individuals 30 off a Home Electric Vehicle charging station plus installation costs. Permitting and inspection fees are not included in covered expenses.

So if you recently installed a home EV charging station or completed a large-scale EV infrastructure project you might still be eligible for this. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 extended the alternative fuel vehicle refueling property credit to cover such properties placed in service in 2021.

Are there any of these tax credits available for 2021 or 2022 if he installs a charging station in his home. And April 7 2021. If so we have great news for you.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. But the following year only electric vehicles made in the US. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

See the IRS guidance Download the IRS form Talk to an Expert Download Our Free Incentives Guide Save Up to 1000 on Your Home EV Charger. Receive a federal tax credit of 30 of the cost of. Unlike some other tax credits this program covers both EV charger hardware AND installation costs.

Microgrids Can Save Americas Carbon-Zero Commitments and Electrified Future The US. Congress recently passed a retroactive federal tax credit for those who purchased environmentally responsible transportation including costs for EV charging infrastructure. The credit amount will vary based on the capacity of the battery used to power the.

About Form 8911 Alternative Fuel Vehicle Refueling Property Credit. A rather significant federal tax benefit is available to most taxpayers who recently installed electric vehicle charging stations and it seemingly is a feature that flew under the radar for many.

An Ev Charger Buying Guide See All Your Options Kelley Blue Book

Tax Credit For Electric Vehicle Chargers Enel X

Electric Car Charging Station Installation Cost Chart Electric Vehicle Charging Station Electric Car Charging Car Charging Stations

Commercial Ev Charging Incentives In 2022 Revision Energy

How To Choose The Right Ev Charger For You Forbes Wheels

Find Charging Options For Your Electric Vehicle Carolina Country

Ev Charging Equipment Tax Credit Extended Solar Electric Contractor In Seattle Wa 206 557 4215

What S In The White House Plan To Expand Electric Car Charging Network Npr

Neat Connect Frog Design Strategy Supermarket Design Parking Design

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Not Nearly Enough Money For Ev Charging In The Infrastructure Bill

Lead The Charge In 2021 Ev Charger Electricity Electric Cars

How To Choose The Right Ev Charger For You Forbes Wheels

Best Level 2 Ev Charger Compare Chargepoint Juice Box Grizzl E Siemens Blink More

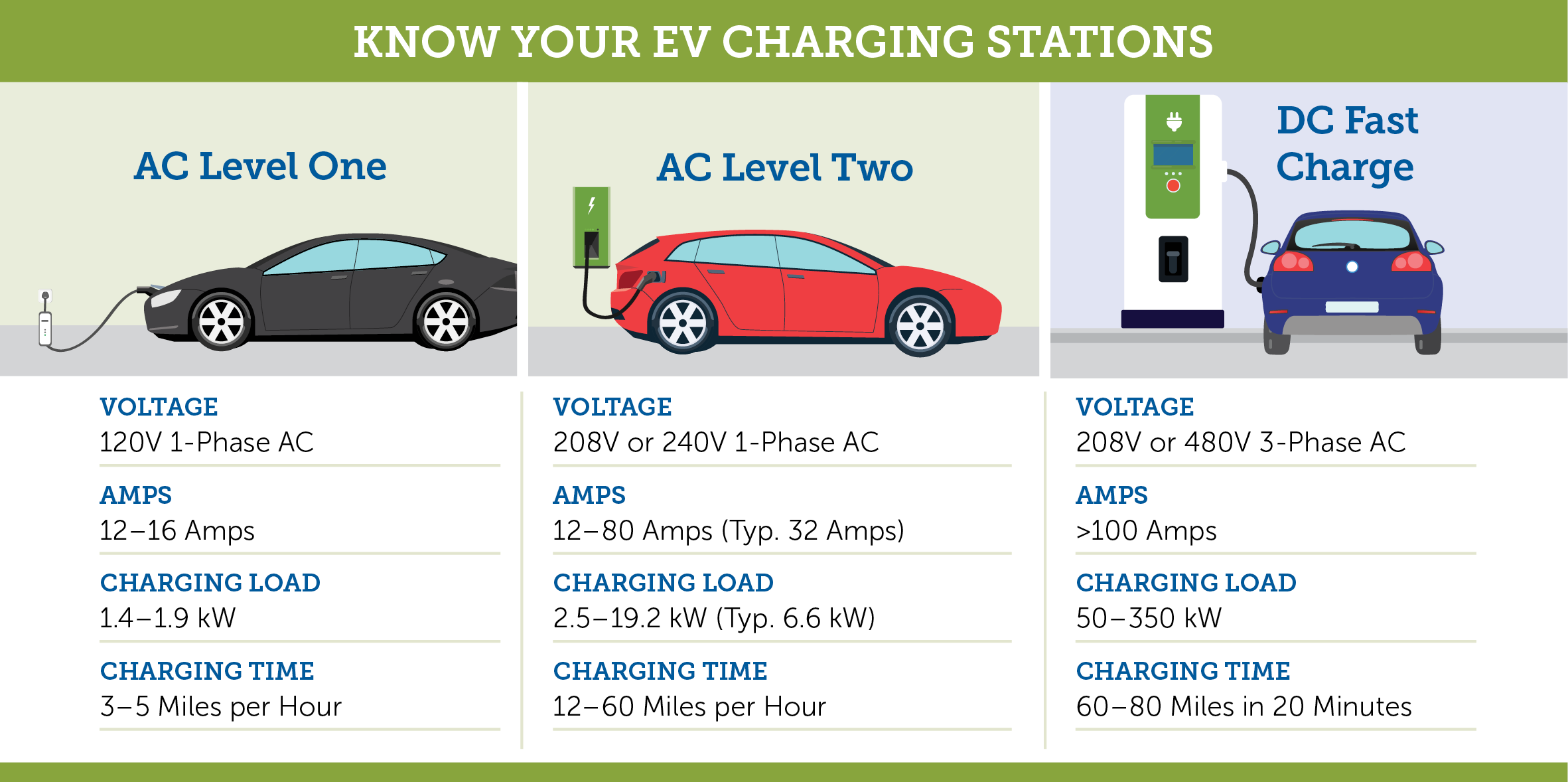

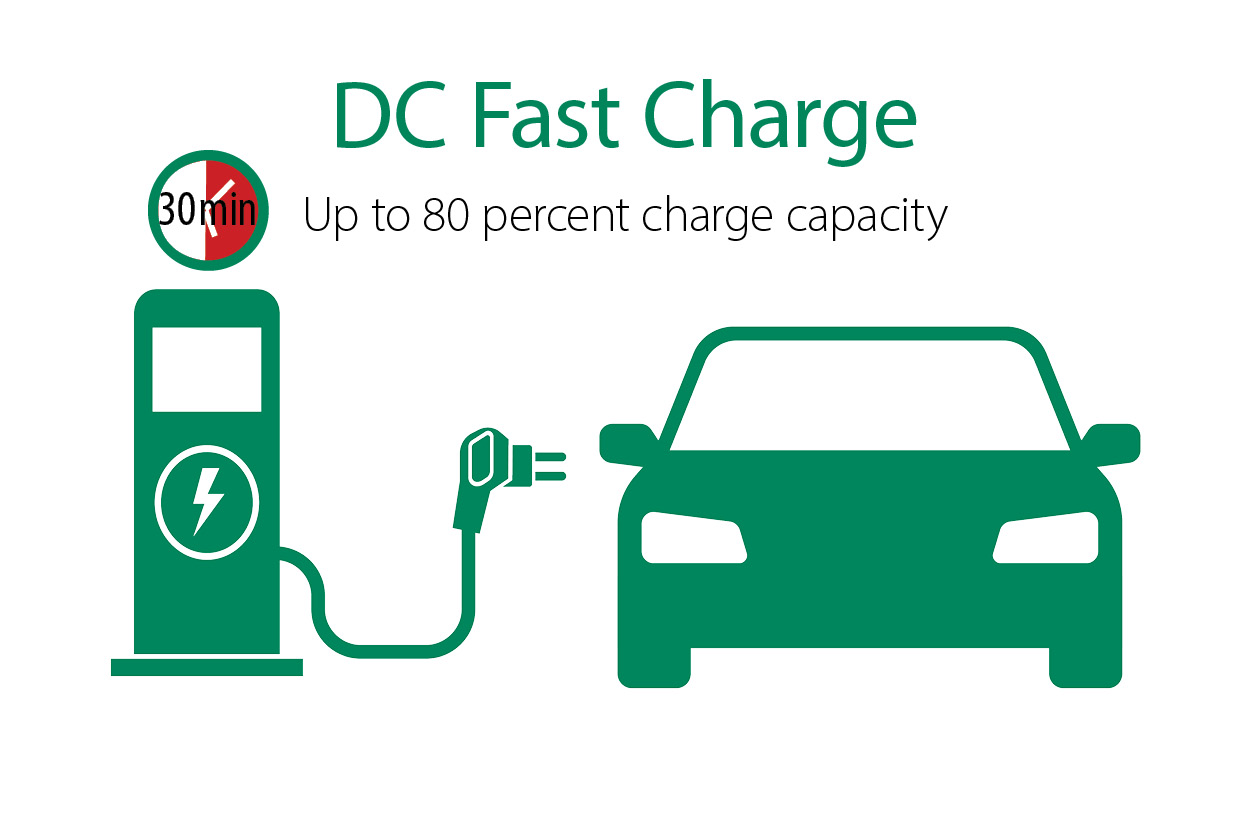

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Ev Charging Stations 101 Wright Hennepin

Rebates And Tax Credits For Electric Vehicle Charging Stations